Pvm Accounting Fundamentals Explained

Pvm Accounting Fundamentals Explained

Blog Article

About Pvm Accounting

Table of Contents6 Easy Facts About Pvm Accounting ExplainedThe Single Strategy To Use For Pvm AccountingNot known Details About Pvm Accounting Getting My Pvm Accounting To WorkThe 45-Second Trick For Pvm AccountingPvm Accounting for Dummies

Guarantee that the audit process conforms with the legislation. Apply called for construction audit requirements and treatments to the recording and reporting of construction task.Understand and preserve common price codes in the accounting system. Communicate with different financing firms (i.e. Title Business, Escrow Business) concerning the pay application procedure and needs needed for repayment. Take care of lien waiver disbursement and collection - https://www.provenexpert.com/leonel-centeno/?mode=preview. Display and deal with financial institution concerns consisting of cost abnormalities and check differences. Assist with carrying out and keeping inner economic controls and treatments.

The above declarations are meant to explain the general nature and level of job being performed by individuals appointed to this category. They are not to be taken as an extensive listing of obligations, tasks, and skills required. Personnel might be called for to do tasks outside of their normal duties every now and then, as needed.

Pvm Accounting Things To Know Before You Get This

You will certainly assist support the Accel group to guarantee distribution of successful on time, on spending plan, jobs. Accel is looking for a Building Accountant for the Chicago Workplace. The Construction Accounting professional performs a selection of bookkeeping, insurance compliance, and task administration. Functions both independently and within details departments to keep financial documents and make certain that all records are maintained present.

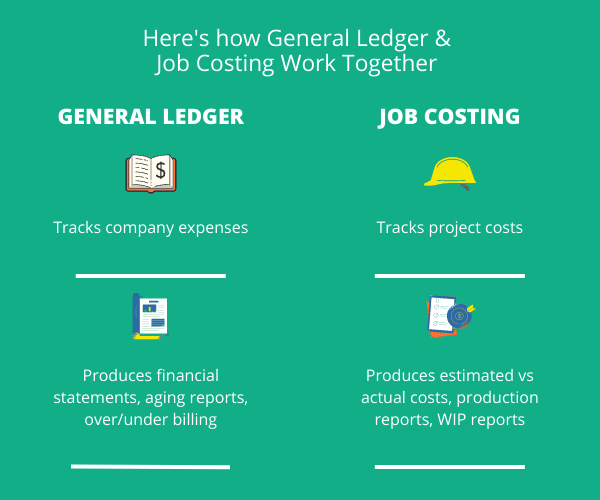

Principal tasks include, however are not restricted to, dealing with all accounting features of the firm in a timely and exact way and providing records and timetables to the company's CPA Firm in the prep work of all economic statements. Guarantees that all accountancy treatments and functions are taken care of accurately. Accountable for all economic documents, payroll, banking and everyday procedure of the accounting function.

Functions with Project Supervisors to prepare and publish all regular monthly invoices. Creates regular monthly Job Price to Date reports and working with PMs to integrate with Job Managers' spending plans for each job.

Pvm Accounting Things To Know Before You Buy

Efficiency in Sage 300 Construction and Realty (previously Sage Timberline Office) and Procore building and construction administration software program a plus. https://pubhtml5.com/homepage/ijerc/. Should additionally be efficient in other computer software program systems for the preparation of records, spreadsheets and other audit analysis that might be required by administration. Clean-up bookkeeping. Must possess solid business skills and capability to focus on

They are the financial custodians who make certain that construction jobs continue to be on budget plan, follow tax obligation regulations, and preserve economic transparency. Building accounting professionals are not just number crunchers; they are critical partners in the building procedure. Their primary function is to take care of the financial elements of building tasks, making certain that resources are allocated efficiently and monetary dangers are lessened.

The 7-Minute Rule for Pvm Accounting

They work carefully with job managers to create and monitor budgets, track expenditures, and projection economic requirements. By preserving a tight grip on project funds, accounting professionals assist avoid overspending and financial troubles. Budgeting is a keystone of successful building projects, and building and construction accounting professionals contribute in this regard. They develop in-depth budgets that encompass all job expenses, from products and labor to licenses and insurance coverage.

Construction accountants are fluent in these laws and guarantee that the job abides with all tax obligation requirements. To excel in the function of a building and construction accountant, individuals need a solid academic structure in audit and finance.

Additionally, certifications such as Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Industry Financial Specialist (CCIFP) are very related to in the industry. Construction tasks usually involve limited due dates, altering regulations, and unanticipated costs.

Pvm Accounting Fundamentals Explained

Ans: Construction accounting professionals produce and monitor spending plans, determining cost-saving opportunities and making certain that the job remains within budget plan. Ans: Yes, construction accounting professionals manage tax obligation compliance for construction tasks.

Introduction to Building a fantastic read Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make tough choices amongst many monetary choices, like bidding on one task over another, choosing funding for materials or tools, or setting a job's earnings margin. Building and construction is a notoriously unstable sector with a high failure rate, sluggish time to settlement, and inconsistent money circulation.

Typical manufacturerConstruction organization Process-based. Production involves duplicated processes with conveniently recognizable costs. Project-based. Manufacturing needs different procedures, materials, and tools with varying costs. Dealt with place. Manufacturing or manufacturing happens in a solitary (or several) regulated locations. Decentralized. Each task takes location in a brand-new location with differing site conditions and unique difficulties.

Some Known Incorrect Statements About Pvm Accounting

Constant usage of different specialty contractors and providers impacts effectiveness and cash flow. Payment gets here in complete or with normal repayments for the full contract amount. Some section of payment may be held back till job conclusion even when the professional's work is ended up.

Normal manufacturing and temporary contracts result in manageable money flow cycles. Uneven. Retainage, sluggish repayments, and high in advance expenses lead to long, uneven cash money circulation cycles - Clean-up bookkeeping. While conventional manufacturers have the benefit of controlled settings and enhanced production procedures, building companies have to frequently adjust to each new task. Even somewhat repeatable tasks require modifications because of site conditions and other aspects.

Report this page